A digital wallet, in the realm of biometric technology, is a secure electronic system that stores sensitive information such as payment credentials, identification documents, and personal data.

Unlike traditional wallets, which hold physical cards and cash, digital wallets operate in the virtual space. They often utilize biometric authentication methods, such as facial recognition, to verify the identity of the user, ensuring maximum security.

These wallets allow users to make seamless transactions online and in-person, eliminating the need for physical cards or cash.

By integrating biometric technology, digital wallets enhance security by adding an extra layer of protection against unauthorized access.

This not only simplifies the authentication process but also mitigates the risk of fraud or identity theft. Digital wallets are revolutionizing the way we manage finances, offering convenience, speed, and peace of mind to users worldwide.

Benefits of a digital identity wallet

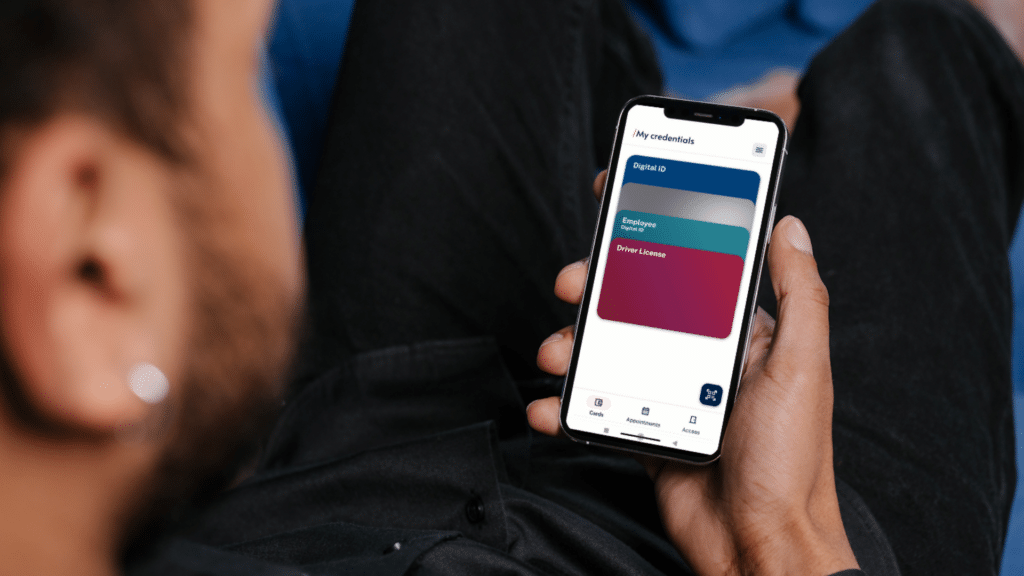

An ID Wallet offers a revolutionary approach to personal identification by securely storing individuals’ biometric and identity information in a digital format on their smartphones or other devices.

Firstly, it enhances security by replacing traditional physical IDs prone to loss or theft with encrypted digital equivalents, safeguarding personal data.

Secondly, it streamlines authentication processes, enabling swift and convenient access to various services, from banking to healthcare, with just a biometric scan.

Moreover, it promotes inclusivity by providing a reliable means of identification for individuals without access to traditional documents, empowering marginalized populations.

Additionally, it reduces administrative burdens and costs for businesses and governments by facilitating seamless identity verification.

Ultimately, a Digital ID Wallet not only enhances security and convenience but also drives efficiency and accessibility in our increasingly digital world.

What is a digital wallet ID?

A digital wallet ID is a secure digital representation of an individual’s identity stored on a device such as a smartphone or a computer.

These IDs utilize biometric data like facial scans, alongside traditional credentials such as passwords or PINs, to authenticate users. Think of it as a virtual version of your physical driver’s license or passport, but much more versatile and secure.

With a digital wallet ID, users can conveniently access various services and conduct transactions online or in-person without the need for physical documents.

This technology streamlines processes like e-commerce, banking, and travel, enhancing both convenience and security.

Plus, by incorporating biometric authentication, digital wallet IDs significantly reduce the risk of identity theft and fraud compared to traditional methods.

In essence, they represent the future of identification, offering a seamless and robust solution for modern digital lifestyles.

Where do you store your digital ID?

Where you store your digital ID is paramount to safeguarding your online presence. Your digital identity encompasses unique biometric data, like facial features and personal information, which must be stored in highly secure databases or systems.

These repositories employ advanced encryption techniques to prevent unauthorized access and cyber threats.

One prevalent method is to store biometric data as vectors or templates rather than raw data. These formats are mathematical representations derived from biometric features and encrypted to make it virtually impossible to retrieve the original information.

Moreover, additional layers of security, such as double authentication factors like combining biometrics with a password or PIN code, can be employed.

Innovative solutions also utilize decentralized storage methods, which distribute your digital ID across a network of nodes, enhancing security and minimizing the risk of a single point of failure.

Digital ID wallets offer secure digital storage for managing your digital identity. By integrating with digital ID wallets, users can securely access and manage their digital identity while maintaining privacy and security.

By embracing these sophisticated storage techniques, your digital ID remains secure, preserving your privacy and safety in an increasingly digital world.

Why do I need a digital wallet identity verification?

A digital ID is like a virtual passport for the digital world, and it’s crucial in today’s tech-driven landscape.

A digital ID offers unparalleled security and convenience. By leveraging biometric data like fingerprints or facial recognition, it ensures that you are who you say you are, thwarting identity theft and fraud.

Plus, it streamlines your interactions online, making transactions, accessing services, and even voting more efficient and secure. Digital IDs also empower individuals by giving them more control over their personal information, allowing for selective sharing of data and enhancing privacy.

In essence, a digital ID is your digital fingerprint, essential for navigating the modern world securely and seamlessly. Whether it’s for banking, healthcare, or simply logging into your favorite social media platform, having a digital ID is a must-have in today’s digital age.

What is the EUDI wallet?

The EUDI (EU Digital Identity) wallet is a cutting-edge application in the realm of biometric technology, revolutionizing how individuals interact with digital services.

EUDI wallet securely stores and manages users’ digital identities, leveraging biometric authentication for enhanced security.

This innovative wallet allows users to access a wide array of online services seamlessly, from banking and healthcare to government portals, all with a simple scan of their fingerprint or facial recognition.

What sets the EUDI wallet apart is its compliance with EU standards for digital identity, ensuring robust protection of users’ personal information while promoting interoperability across various platforms and services.

By centralizing digital identities within a secure and user-friendly application, the EUDI wallet simplifies online interactions and strengthens trust in digital transactions.

It represents a significant step towards a more secure, convenient, and inclusive digital future for all EU citizens.

Is digital ID safe to use?

Digital IDs are indeed safe to use when properly implemented. Biometric authentication, such as facial recognition, adds an extra layer of security, making it difficult for unauthorized individuals to access your digital identity.

However, like any technology, the safety of digital IDs depends on various factors, including encryption methods, data storage practices, and user privacy protections.

When designed with robust security measures and compliance with privacy regulations, digital IDs offer significant advantages in terms of convenience and protection against identity theft and fraud.

Nevertheless, it’s essential to choose reputable providers as Veridas and remain vigilant against potential threats such as phishing attacks or data breaches.

Overall, with the right safeguards in place, digital IDs are a secure and efficient way to navigate the digital world, offering peace of mind and enhanced protection for users’ personal information.

Is a digital wallet safer than a card?

Digital wallets offer enhanced security compared to traditional cards due to their biometric authentication features.

Biometric technology ensures that only authorized users can access the wallet. This significantly reduces the risk of unauthorized transactions or identity theft, as physical cards can be lost, stolen, or copied.

Additionally, digital wallets often utilize tokenization, which replaces sensitive card information with a unique digital token, further safeguarding financial data from potential breaches.

Moreover, digital wallets offer multi-factor authentication options, adding layers of protection.

In contrast, physical cards rely primarily on PIN codes or signatures, which are susceptible to theft or observation. Thus, the integration of biometric authentication makes digital wallets a safer and more secure option for conducting transactions, providing users with peace of mind regarding the safety of their financial information.

What is the difference between mobile payment and digital wallet?

Mobile payment and digital wallets are two interconnected yet distinct concepts in the realm of biometric technology.

Mobile payment refers to the process of using a mobile device, like a smartphone or smartwatch, to make transactions.

This technology leverages Near Field Communication (NFC) or Quick Response (QR) codes to facilitate secure transactions at points of sale.

On the other hand, a digital wallet is a software application that securely stores payment information and credentials for various payment methods, including credit/debit cards, loyalty cards, and even cryptocurrencies.

While mobile payments occur through the mobile device, digital wallets serve as the repository of payment data, enabling users to conveniently manage and access their financial information.

Biometric authentication, like facial recognition, can enhance security in both mobile payments and digital wallets, ensuring secure and seamless transactions.