Safeguard your business against fraud where it happens most. Veridas’ fully automated, AI-driven document verification ensures over 99% accuracy worldwide, eliminating fraud without human intervention and providing a seamless experience for your customers.

Document fraud represents over +90% of all fraud attempts in identity verification. Veridas’ AI-driven document verification detects forged or manipulated documents, ensuring authenticity, enhancing security, and protecting your reputation.

With Veridas’ fully automated verification, manual reviews become obsolete, drastically expediting the document verification process. This streamlined experience heightens satisfaction, driving acquisition rates while achieving an impressive average document verification rate of 98%.

Veridas supports over +99% of documents worldwide, enabling your business to operate seamlessly across borders. This comprehensive coverage allows you to expand your customer base and drive business growth without regional limitations.

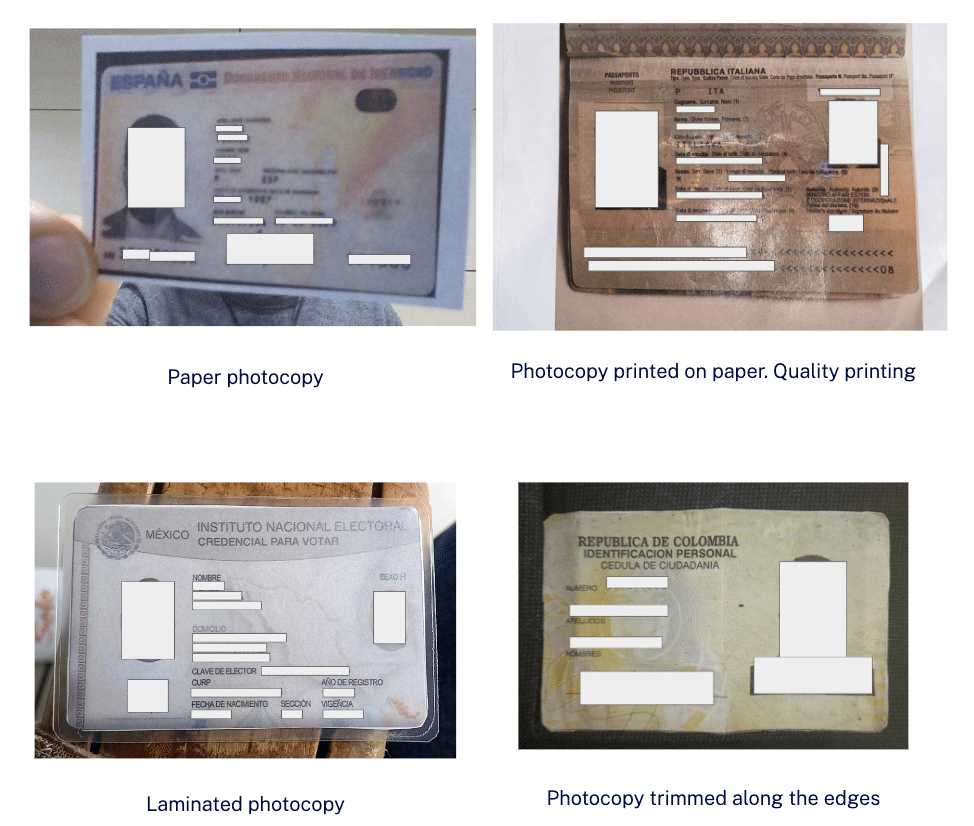

Our technology performs detailed security checks to confirm whether a document is genuine or has been falsified, forged, photocopied (print attack), or displayed on a screen (replay attack). This comprehensive verification process is crucial for preventing fraud and ensuring document authenticity in an automated identity verification process.

Accurately reads data from VIZ, MRZ, two-dimensional codes, and NFC chips in over 99% of documents worldwide. The 100% proprietary OCR engine is specially trained to capture all visible information from both the front and back of identity documents, achieving accuracy greater than 99% in most fields. It supports OCR reading in any language, including Latin, Arabic, Chinese, and Cyrillic alphabets, as well as special characters such as Á, à, â, ä, and others. This ensures perfect document reading for security verifications and reduces error rates by auto-extracting necessary data, enhancing the overall user experience.

White-labeled SDKs for seamless capture on all platforms: Web Desktop, Mobile (HTML), and Webviews (Facebook, Instagram, and Native Webviews), ensuring a smooth user experience, increasing conversion rates and enabling customer acquisition from every channel.

The AI-powered classification engine automatically identifies the type of identity document from an image without requiring the user to specify the country or document type. This simplifies the process and enhances accuracy.

Document verification is the process of digitally authenticating identity documents, such as passports or driver’s licenses, to ensure their validity and protect against fraud. Veridas’ AI-driven solution automates this process by analyzing key security features and comparing the data to global standards. With support for over 99% of identity documents worldwide, this technology checks for signs of forgery or manipulation without requiring manual review. The system guarantees fast, accurate verification, ensuring that documents are genuine and providing a secure, seamless user experience

Yes, Veridas can quickly add new documents to its coverage. With a dedicated Technology and Legal team that continuously monitors official state publications for new identity documents, Veridas can include these documents in less than a week. Since the solution is fully proprietary, all that’s required is a template of the new document, such as one from the PRADO database. Once added, the document benefits from the full range of Veridas’ capabilities, including classification, OCR, and validation features. This ensures up-to-date and comprehensive global document coverage.

The validation of an identity document depends on two factors.

Listed below are the checks the product performs to verify that the document is authentic.

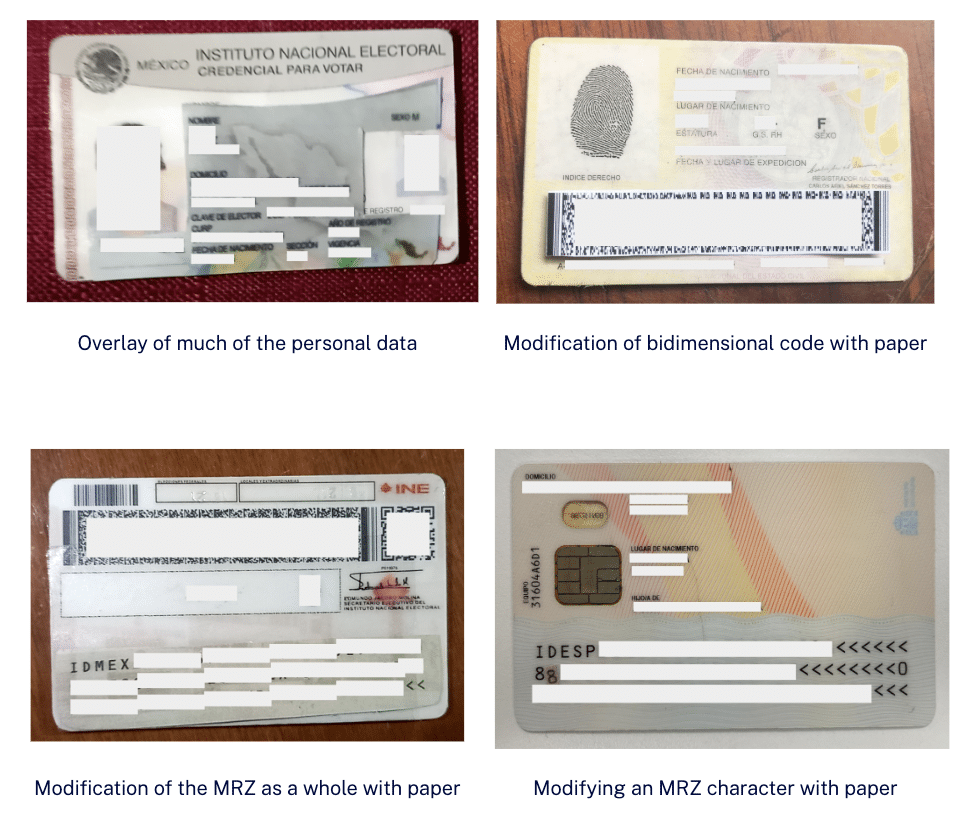

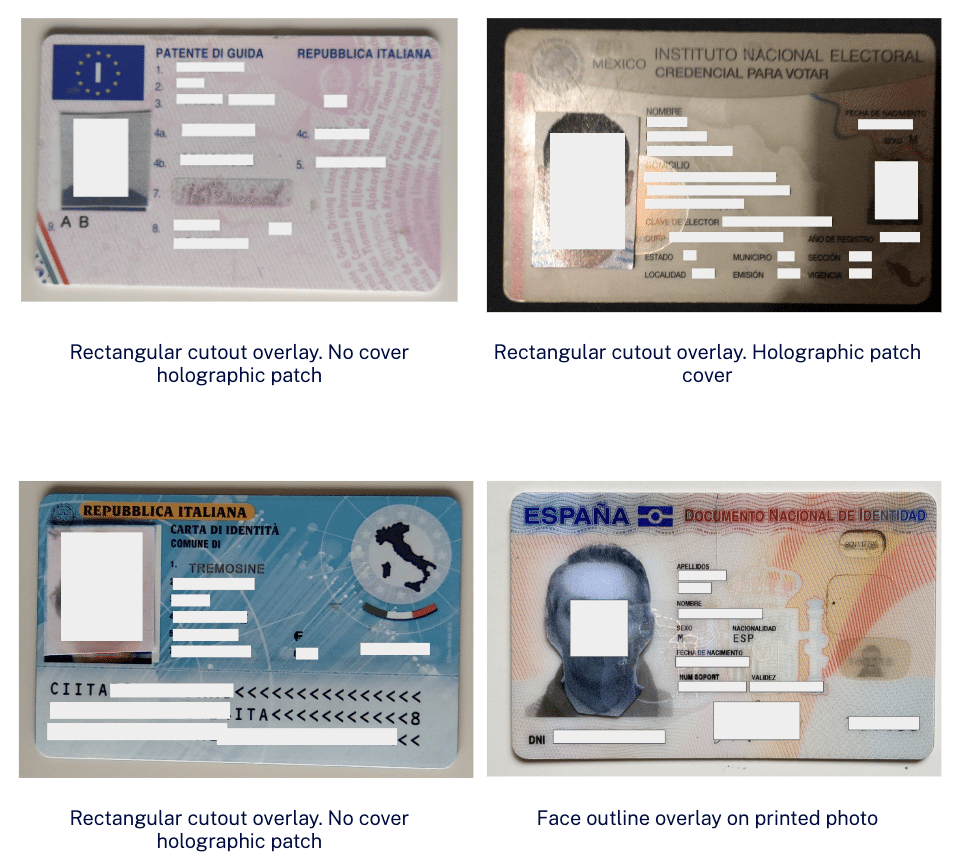

With over 10 years of experience and millions of documents analyzed, Veridas has detected several common types of fraud. These include:

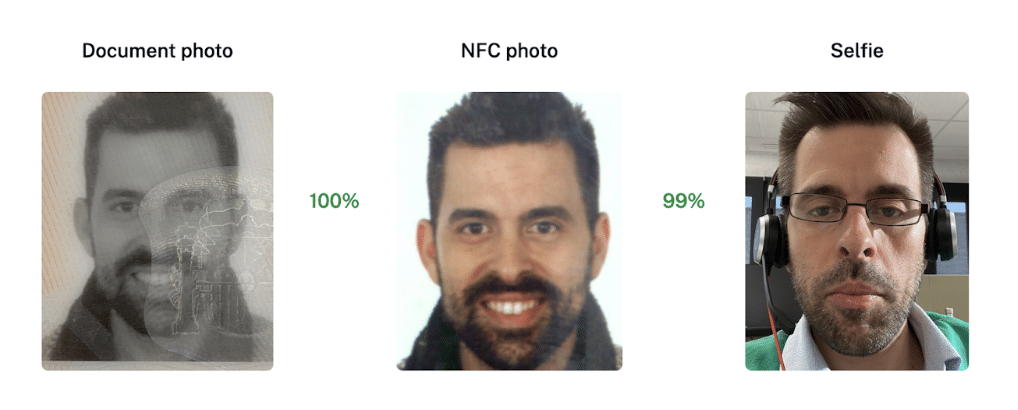

Yes, Veridas uses NFC technology in both Android and iOS environments to read the NFC chips embedded in passports, national identity documents, and residence permits. This technology extracts all personal data stored on the chip, such as the identification number, name, date of birth, and more. Using NFC ensures that the data is error-free, as it bypasses the need for OCR. Veridas also compares the data on the chip with the information printed on the document (VIZ and MRZ) for consistency and conducts biometric verification between the printed and chip-stored photos to detect potential tampering.

Yes, Veridas can process previously captured images, even if the documents are in different orientations or on various types of backgrounds. The engine is capable of accurately processing documents regardless of the background, including light or dark homogeneous backgrounds, non-homogeneous backgrounds with or without patterns, and even out-of-focus backgrounds. This flexibility allows clients to use images already captured in a wide range of environments for document verification.

Detailed technical documentation is available to explain the different scenarios in which these images can be processed.

Yes, Veridas allows the processing of up to three documents during the same identity verification process. This is useful in scenarios where more than one document is required, such as verifying both an ID and a driver’s license for remote vehicle rentals, or when combining a document with fewer security measures with a more secure document like a passport. Veridas verifies the authenticity of each document individually and performs a biometric comparison between the photos on the documents to ensure they belong to the same person. If a document lacks a printed photo, the client can implement additional checks, such as comparing identification numbers or names.

/Let’s talk!

Become part of our network and add the best verification solution on the market to your product catalog.

Simplify entry, save time, and manage your stadium parking more efficiently.

Enter the parking area in under 1 second with facial recognition technology.

Simplify the ticket purchase process and enable attendees to enjoy a hands-free experience throughout their stadium stay.

Elevate your parking security for peace of mind.

Protect your Stadium with our end-to-end identity verification platform, featuring biometric and document verification, trusted data sources, and fraud detection.

Verify your attendees’ identity remotely in less than 1 minute.

Simplify the ticket purchase process and enable attendees to enjoy a hands-free experience throughout their stadium stay.

Enhance the security of the purchase process, eliminating the possibility of fraud, resale, and unauthorized access.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.