On November 28th, Veridas and Banco BPI joined forces for an exclusive event at the Fintech House Auditorium in Lisbon. The gathering brought together leaders from key sectors such as banking, insurance, telecommunications, and mobility, aiming to explore how digital identity innovation can transform the customer experience and optimize critical processes such as digital onboarding in a regulated environment.

Client onboarding for banks

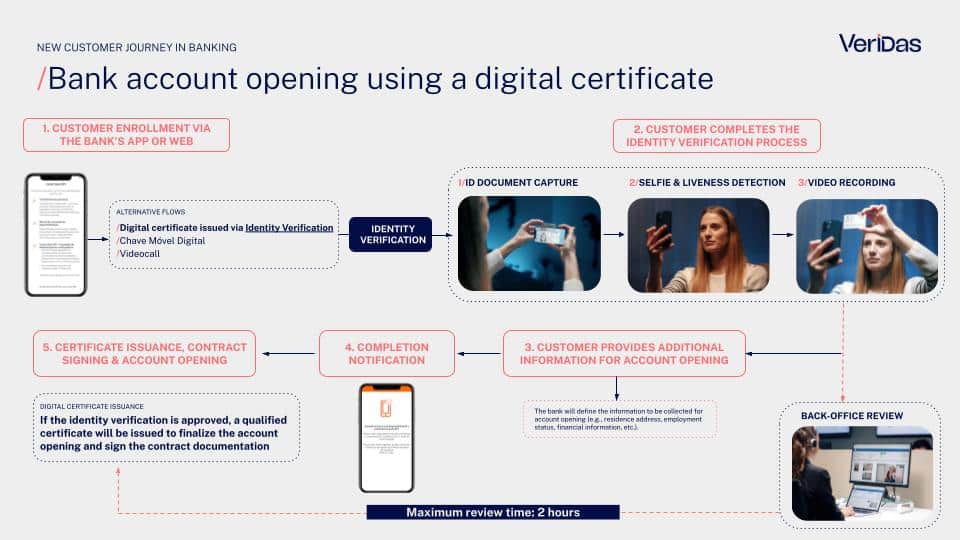

Attendees had the opportunity to discover how Veridas’ solutions not only meet the stringent regulatory frameworks in Portugal but also ensure maximum accessibility, fraud prevention, and conversion in the customer onboarding process for banks.

Key discussion points highlighted the tangible benefits Veridas’ solutions offer to the Portuguese financial sector:

- Market-leading conversion: Up to 90% in the digital onboarding funnel, eliminating the need for video calls or Chave Móvel Digital.

- Regulatory compliance: Full compliance with the Banco de Portugal regulations.

- Universal accessibility: Capability to onboard clients from up to 190 different nationalities.

- Advanced security: Prevention and detection of identity fraud at every step of the process.

The Future of Banking Onboarding: Innovation with Compliance

The first part of the event focused on presenting “The New Digital Customer Onboarding for Portuguese Banks”, a session led by Pablo Amilibia, Veridas’ Regional Director in Portugal. During his talk, Amilibia explained how Veridas is redesigning the digital onboarding process in Portugal, adapting it to both legal requirements and the expectations of modern customers.

“We are a 100% proprietary technology company, which gives us the flexibility to respond quickly to our customers’ needs without relying on third parties.”

Pablo Amilibia (Veridas)

Thanks to this technological independence, Veridas was the first to include the new Portuguese Cartão de Cidadão in its document coverage, just days after its official launch. This is possible because the company develops its solutions in-house, allowing direct connections to the experts behind each line of code.

Amilibia also highlighted the robustness of the solution:

- Veridas verifies over 100 million identities annually in more than 25 countries, using cutting-edge biometric technology.

- Its standards comply with international certifications like ISO 27001, 9001, and SOC 2, SOC3, ETSI, iBeta levels 1 and 2, and it leads global rankings like the NIST FRVT.

- In Portugal, it fully complies with Law 83/2017, which enables remote customer identification using qualified electronic certificates issued under the European eIDAS regulation.

This solution not only accelerates the digital onboarding process, verifying identities in under a minute, but also facilitates integration with existing systems due to its modular, plug-and-play architecture.

Identity as a Business Catalyst: Acquire, Retain, Protect, and Grow

The most anticipated moment of the event was the panel discussion with Madalena Lourenço, Head of Self-Service Channels at Banco BPI, and Jordi Torres, General Manager EMEA at Veridas. During this dialogue, both leaders delved into the challenges and successes of implementing an innovative digital identity solution in the Portuguese market.

Madalena Lourenço (Banco BPI): A New Era in Customer Experience

From Banco BPI’s perspective, the customer experience during onboarding is a critical factor for success. Lourenço pointed out:

“The first impression a customer has is during onboarding, a crucial moment. Customers expect a fully digital, user-friendly, and secure experience. This is what Veridas offers us through a plug-and-play, customizable solution that easily integrates with our systems while perfectly balancing user experience, regulatory compliance, and robust technology.”

Madalena Lourenço (Banco BPI)

Lourenço emphasized how this solution transforms not only the digital process but also the traditional one, as even in branches, managers guide clients to use the digital flow on their devices. “We are changing the account opening paradigm. What we are building will transform how bank accounts are opened in Portugal.”

Additionally, Lourenço pointed out that “onboarding is just the beginning” because Banco BPI is taking the experience a step further:

- Implementing biometric authentication to authorize transactions with face and voice, replacing traditional methods like OTPs with a more secure and effective solution.

- Reusing the customer’s identity and biometric profile to enable multiple use cases across digital channels.

Regarding the collaboration between the two companies, Lourenço noted, “Veridas was more than a technology provider; they co-created the solution with us, supporting the design of the user experience and guiding us through legal compliance and implementation from day one.”

Jordi Torres (Veridas): Technology Serving Business Growth and Fraud Prevention

For his part, Jordi Torres also highlighted Veridas’ role as a strategic consultant, beyond just a technology provider:

“BPI highlighted that Veridas was not just a technology provider; we went much further. Our first conversation with Banco BPI was not centered on a specific use case, but on imagining what we could achieve together, with identity as the cornerstone, acting as their strategic partner, their ‘Chief Identity Officer.'”

Jordi Torres (Veridas)

Torres shared an inspiring example: Veridas’ collaboration with BBVA since 2017. At that time, only 5% of accounts were opened remotely; today, thanks to Veridas technology, that percentage has grown to 65% globally. BPI, a pioneering and innovative bank, follows this same path: “Thanks to their bold and visionary approach, BPI has adopted our complete technology stack, enabling them to grow, retain, and protect their customers in transformative ways. Digital onboarding is just the first step in this evolution.”

Additionally, Torres warned about the evolution of fraud, stressing the importance of using AI to combat advanced threats:

“Today, a fraudster can download an app to clone a voice, face, or document. The only way to protect yourself is by using advanced technology. A machine can deceive a human, but not another machine.”

A New Standard for the Portuguese Market

The event made it clear that the collaboration between Banco BPI and Veridas is setting a new benchmark in Portuguese banking. This partnership not only establishes a new standard for digital onboarding but also demonstrates how technology and shared vision can overcome complex challenges, from integration with legacy systems to regulatory compliance.

With this solution, Banco BPI is not only leading the digital transformation but also protecting its customers and strengthening trust in a market where security and user experience are paramount.