In recent years, the rise of synthetic identity fraud has transformed the cybercrime landscape. According to recent data, there has been a staggering 2137% increase in fraud attempts since 2021, and approximately 85% of bank fraud now leverages AI-generated fake identities.

Even more concerning, statistics show that between 1 and 3% of digital customer registration processes in banking involve advanced injection attacks, underscoring how pervasive and sophisticated this type of fraud has become. These alarming figures highlight the urgent need for robust security measures, especially as more financial services shift to digital platforms.

At Veridas, we recognize that the proliferation of synthetic identity fraud is not merely a statistical concern but a serious threat to the integrity of digital identity systems worldwide. Fraudsters increasingly employ cutting-edge methods—ranging from deepfakes to injection attacks—to deceive both users and institutions.

Our mission is to provide comprehensive fraud detection solutions that tackle this evolving threat head-on. This article offers an in-depth look at synthetic identity fraud, exploring its definition, mechanics, prevention strategies, and the crucial steps organizations must take to report and fight it effectively.

What Is Synthetic Identity Fraud?

Definition & Meaning

Synthetic identity fraud is a form of cybercrime wherein fraudsters construct entirely new identities by blending authentic personal information with fabricated data. Unlike conventional identity theft, which involves stealing and misusing an existing individual’s personal details, synthetic identity fraud aims to create a “person” who exists only in the digital realm.

This may include combining a genuine Social Security number (belonging to someone with minimal or no credit history) with an invented name, date of birth, or address, culminating in a composite identity that is challenging to detect through standard verification processes.

At Veridas, we see synthetic identity fraud as a direct consequence of advanced digital manipulation techniques. Fraudsters leverage emerging technologies, including AI-driven image and deepfake voice generation, to craft identities that can pass basic security checks.

The end goal is typically financial gain—using the fraudulent identity to open bank accounts, apply for credit cards, or secure loans. However, the impact can extend beyond financial institutions, affecting e-commerce platforms, insurance companies, and government agencies.

Understanding the true nature of synthetic identity fraud is the first step toward developing robust defense mechanisms against it.

How It Differs from Traditional Identity Theft

While both synthetic identity fraud and traditional identity theft involve the misuse of personal information, there is a key distinction in how these crimes are perpetrated.

In traditional identity theft, a criminal steals and uses someone’s genuine identity—often hijacking bank accounts, filing fraudulent tax returns, or applying for credit in the victim’s name. This crime leaves behind a clear victim: the real person whose identity has been compromised.

Synthetic identity fraud, on the other hand, often relies on data points that do not correspond to a single, real individual. Fraudsters might repurpose legitimate elements, such as a Social Security number, but combine them with invented details, like a fictitious name or address.

This fusion of real and fake information makes synthetic identities harder to trace and detect because there is no singular “victim” who can report the fraud. Financial institutions and businesses may only discover the deception once the criminal has racked up debts or committed other fraudulent activities. This complexity demands advanced detection methods that go beyond traditional identity theft prevention.

How Synthetic Identity Theft Works

Common Methods Used by Fraudsters

Presentation Attacks

One of the first methods fraudsters employ is the presentation attack, where they deliberately present falsified or altered biometric data to an authentication system. This could involve using high-resolution photographs, realistic masks, or even manipulated videos.

The primary objective is to trick the system into recognizing a counterfeit face or voice as genuine. These attacks fall under what we often refer to as “analog” attacks, given that they involve the physical presentation of fake biometric artifacts to a capture device.

At Veridas, we counter presentation attacks by implementing robust liveness detection systems that analyze subtle cues indicating whether the biometric input is genuine or not. This can include tracking minute facial movements or voice intonations that are difficult to replicate using static images or recordings. By employing AI-driven techniques, our solutions can swiftly distinguish between legitimate biometric data and manipulated analog inputs, thereby thwarting a key method used by fraudsters.

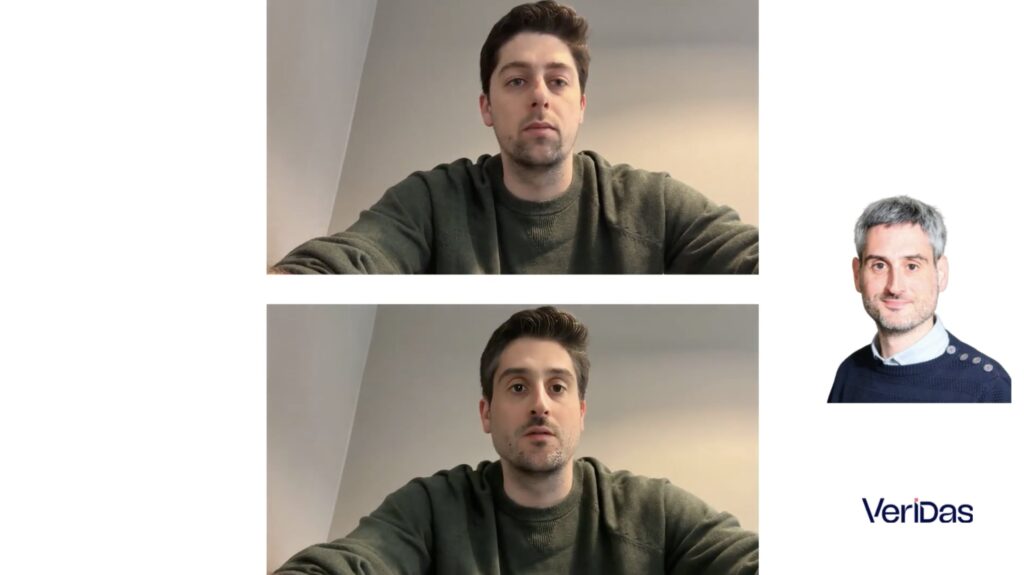

Injection Attacks

Moving from analog to digital, injection attacks involve the unauthorized introduction of fake biometric data directly into the authentication process, often bypassing physical presentation. Fraudsters may insert deepfake videos or synthetic audio feeds, tricking the system into believing it is receiving data from a legitimate capture device.

This technique is particularly insidious because it avoids the pitfalls of analog manipulation, relying instead on advanced AI-generated content that can mimic real human traits with startling accuracy.

To address injection attacks, Veridas has developed advanced injection attack detection technology capable of verifying device authenticity during onboarding and authentication. By analyzing the data transmission process, we can detect anomalies that indicate fake inputs are being “injected” rather than captured in real time. This technology is especially critical in a digital ecosystem where between 1 and 3% of banking customer registration processes may involve advanced injection attacks.

Man-in-the-Middle (MITM) Attacks

While presentation and injection attacks focus on manipulating the data at the point of capture, man-in-the-middle (MITM) attacks target the transmission of biometric data during verification. In these scenarios, an attacker intercepts the communication between the user and the web application, potentially altering or redirecting the data to mislead the authentication system. MITM attacks fall under the category of “digital attacks” because they exploit network vulnerabilities rather than physical or direct data manipulation.

Veridas mitigates MITM threats through secure data encryption and continuous monitoring of the authentication channel. By ensuring that biometric data is protected during transmission, our systems prevent attackers from intercepting or modifying the data en route. This multi-layered approach—covering analog, digital, and injection threats—allows us to address the full spectrum of fraudulent techniques fraudsters employ to create synthetic identities.

Real-World Examples of Synthetic ID Fraud

Fraudsters often employ synthetic identities to secure loans, open bank accounts, or even file fraudulent insurance claims. In one documented case, a criminal syndicate used AI-generated facial images paired with real Social Security numbers to pass a bank’s initial verification checks. Over several months, they established a “credit history” for the synthetic identity, eventually applying for high-limit credit cards and racking up significant debt before disappearing. This scenario highlights how synthetic identity fraud can remain undetected until substantial financial damage has already been done.

Another real-world example involves deepfake audio. Fraudsters have impersonated company executives by synthesizing voice recordings that instruct finance departments to initiate urgent wire transfers. By combining genuine phone numbers with deepfake voice technologies, criminals can convincingly simulate legitimate requests, leaving little room for suspicion until it’s too late.

These cases underscore the evolving sophistication of synthetic identity fraud, which increasingly relies on AI-generated content to bypass traditional security measures. Veridas addresses these threats by integrating deepfake detection capabilities, analyzing both visual and auditory cues to confirm the authenticity of user interactions.

How to Prevent & Detect Synthetic Identity Theft

Prevention Strategies for Individuals & Businesses

Preventing synthetic identity fraud demands a multi-layered approach that incorporates strong user verification, real-time monitoring, and continuous adaptation to emerging threats. For individuals, safeguarding personal data is paramount—this includes limiting the amount of sensitive information shared on social media and using secure channels for official communications. However, individual vigilance alone is insufficient, especially given the rise of advanced AI-driven manipulation techniques.

Businesses and financial institutions must adopt robust onboarding processes that go beyond basic identity checks. By verifying the authenticity of documents, cross-referencing data against reputable sources, and employing advanced biometric authentication, organizations can detect inconsistencies early.

At Veridas, we emphasize device authenticity checks to ensure that the data being captured comes from a legitimate source rather than a synthetic injection. According to our latest findings, between 1 and 3% of digital onboarding processes in banking may involve advanced injection attempts, making such checks vital to preventing synthetic identities from infiltrating systems.

Veridas has also taken a pioneering role in the fight against AI-driven fraud by introducing a new advanced injection attack detection capability. This innovative technology ensures that any fake biometric data, including deepfake content, is flagged at the point of entry.

By verifying both the user’s biometric data and the device itself, we can stop fraud at its origin, thereby protecting financial institutions and their clients from long-term damage. This capability is particularly crucial given the 85% of bank fraud now involving AI-generated fake identities, illustrating the urgent need for solutions that can identify and block these attempts from the outset.

Synthetic Fraud Detection Techniques

Detecting synthetic identity fraud requires more than just manual reviews or rule-based systems. Fraudsters are increasingly adept at bypassing conventional security checks, necessitating advanced technologies that can adapt and learn over time. One key technique employed by Veridas is continuous behavioral analysis, which evaluates user interactions for anomalies indicative of synthetic identities. By mapping typical user behaviors and flagging deviations, our system can quickly pinpoint suspicious activities.

In addition to behavioral analysis, we rely on machine learning models trained on extensive datasets of known fraudulent and legitimate behaviors. These models can spot patterns that human analysts might miss, from subtle inconsistencies in data fields to irregular login times or geolocation mismatches.

The system then assigns risk scores to user activities, enabling organizations to focus their investigative efforts where they are most needed. This approach is particularly effective in combating synthetic identity fraud, where criminals often combine elements of real data with AI-generated information to evade detection.

Another pivotal technique is deepfake detection, which is becoming increasingly relevant in a world where 85% of bank fraud is fueled by AI-generated identities. Veridas employs algorithms designed to analyze facial micro-expressions, speech patterns, and other biometric markers that are difficult to replicate perfectly.

By comparing these markers to known real-world baselines, our technology can identify discrepancies that signal the presence of deepfake manipulation. This level of scrutiny is essential for financial institutions looking to maintain trust in their digital channels and prevent criminals from exploiting advanced AI tools to create convincing, yet entirely fictitious, identities.

Reporting & Fighting Synthetic Identity Fraud

How to Report Synthetic Identity Theft

Reporting synthetic identity theft is a crucial step in mitigating its impact and preventing further damage. Financial institutions and businesses should establish clear protocols that allow employees and customers to flag suspicious activities swiftly.

These protocols typically involve gathering all relevant documentation—such as login logs, suspicious transaction records, or any communication evidence—and presenting it to the designated fraud prevention or compliance team. Once the internal investigation confirms fraudulent activity, the case should be escalated to law enforcement agencies.

Veridas recommends documenting each step of the discovery and verification process to provide law enforcement with a clear narrative of how the synthetic identity was constructed and used. This documentation often includes evidence of injection attacks or deepfake usage, as well as any inconsistencies in personal data that were detected.

By sharing these findings with regulatory bodies and other institutions, organizations can contribute to a collective understanding of emerging threats, helping to refine industry-wide standards and best practices. Early and transparent reporting also ensures that potential victims are informed about the situation, enabling them to take proactive measures to secure their accounts and personal data.

Individuals who suspect they have been affected by synthetic identity fraud should likewise report their concerns to relevant authorities and financial institutions as soon as possible. Prompt action can limit the extent of the fraud and improve the chances of recovering lost funds.

Veridas supports organizations in this reporting process by offering detailed fraud detection reports that can be used as part of official documentation. These reports can also serve as valuable training resources for investigators, equipping them with insights into the ever-evolving tactics of fraudsters.

The Role of Financial Institutions & Regulations

Financial institutions occupy a pivotal position in the fight against synthetic identity fraud. Given that many fraudulent activities involve opening new accounts, securing loans, or executing unauthorized transactions, banks and other financial entities are often the first to encounter suspicious behavior.

By implementing advanced verification measures, including biometric authentication and injection attack detection, they can thwart fraudulent attempts before they escalate. Veridas collaborates closely with banks and fintech companies to ensure their digital onboarding and transaction monitoring systems are optimized for identifying synthetic identities.

Regulatory bodies also play an essential role by setting the standards and guidelines for identity verification and fraud prevention. As synthetic identity fraud continues to rise, agencies are increasingly emphasizing robust Know Your Customer (KYC) procedures, ongoing customer due diligence, and secure data handling.

Veridas supports these regulatory requirements by providing technology that aligns with compliance frameworks while maintaining user-friendly experiences. Through a combination of stringent regulations and cutting-edge solutions, the industry as a whole can adapt to the evolving threat landscape.

Collaboration between financial institutions, regulators, and solution providers is critical to fostering a secure environment. By sharing insights, data, and best practices, stakeholders can stay informed about the latest methods fraudsters employ, from sophisticated deepfake techniques to injection attacks.

This knowledge exchange not only strengthens existing defenses but also informs the development of new strategies and technologies. At Veridas, we remain committed to facilitating these collaborative efforts, ensuring that our solutions evolve in tandem with emerging threats and regulatory shifts.

Veridas, the best solution against Synthetic Identity Fraud

By employing a multifaceted approach—covering analog, digital, and injection-based attacks—Veridas provides organizations with the tools needed to detect, prevent, and report synthetic identity fraud.

Our commitment to innovation, collaboration with regulatory bodies, and continuous refinement of advanced technologies ensures that we stay at the forefront of this ongoing battle. From implementing robust liveness detection to deploying cutting-edge injection attack countermeasures, we stand ready to protect digital identities against an ever-evolving threat landscape.

Ultimately, the path to detect synthetic identity fraud lies in vigilance, technology, and collective action. Institutions must remain informed about emerging threats and adopt advanced verification solutions that can keep pace with the rapidly changing tactics of fraudsters.

By understanding the mechanics of synthetic identity theft and actively engaging in prevention, detection, and reporting, we can safeguard the digital ecosystem, preserving trust and integrity for businesses and consumers alike.