In keeping with its characteristic focus on innovation, the BBVA group has once again broken new ground by establishing the first 100% digital bank in Italy, where more than 720,000 people have already registered thanks to Veridas’ onboarding technology.

In order to offer a fully online service to its customers, it was essential to have a reliable, secure, and convenient remote identity verification method for users.

The solution chosen was Veridas’ onboarding, as it met all the accuracy and convenience requirements demanded by an entity of this nature.

This project marks another milestone in the long and extensive collaboration between Veridas and the BBVA group. Since launching the first digital customer registration in Spain in 2017, more than 55 use cases have been developed in nine different countries.

Digital innovation to lead the way in Italy

BBVA Italia’s top positions in various rankings reflect the success of its commitment to digital transformation. It ranks number one among banks in Italy in 2024, according to Bain & Company’s NPS Prism report, a key benchmark for measuring customer satisfaction.

In addition, it shares the highest score in the Italian banking sector with another institution, with an outstanding 4.8, confirming the excellence of the digital experience it offers.

Added to this is its first place ranking in customer service, awarded by Statista and Corriere della Sera in June 2025, which validates the bank’s commitment to providing friendly, efficient, and high-quality service. These achievements not only position BBVA Italy as a leader in the sector, but also reinforce the positive impact of its collaboration with Veridas in the development of cutting-edge technological solutions.

A unique customer experience

In 2021, 38 million BBVA Italy customers interacted with the bank digitally, more than 62% through the mobile app, and 7 out of 10 sales were made digitally.

BBVA had already had a presence in Italy for more than 30 years through wholesale banking and it was in 2021 when they decided to take the step to offer their services also to the retail service.

BBVA Italia was born as a 100% digital bank committed to innovation and the digital transformation of banking in Europe. To make this possible, it was essential to have all the security guarantees present in traditional banking.

How can you offer the same services without interacting with your customers in person?

El caso de éxito en cifrasUniversal bank with...

Veridas Digital onboarding, a key step in the process

Veridas’ digital onboarding has enabled BBVA Italia to open up a world of digital possibilities in a new market for the financial group.

User onboarding is the first step in the customer lifecycle and one of the most critical points for fraud prevention.

Thanks to the Veridas solution, BBVA Italia offers a fast and simple onboarding process that offers at the same time all the guarantees of security and regulatory compliance.

Universal bank with...

Current account + Payments

Loans (OCL, P&P, Payroll advanced)

Deposits

Debit and credit card

Investments (i.e., funds)

Insurance

Digital growth begins with a seamless sign-up process...

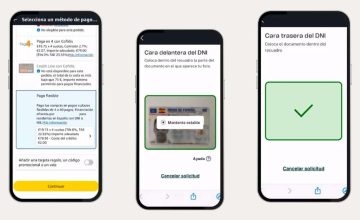

It is a 100% automated process (no human in the loop) and with global coverage all over the world. The user only has to follow these simple steps from their own device anywhere and at any time:

- ID document scanning: The customer must scan both sides of his ID document. Our document verification technology runs more than 30 artificial intelligence algorithms to analyze the authenticity of the document.

- Biometric comparison: The second step is to ensure that the person performing the process is the same as the one shown on the ID document. To do this, the customer must take a simple selfie and our facial biometrics engines (evaluated by NIST), determines if it is the same person. In addition, this process incorporates anti-fraud measures to detect identity theft such as screen attacks or 3D masks.

“At BBVA, we arrived in Italy with the ambition of becoming the benchmark ‘Zero Commission Everyday Mobile Bank’ for our customers, offering a commission-free mobile banking experience, with tools that help customers save and control their expenses conveniently and easily from the app, and with financing products tailored to everyday needs, available at the click of a button and with very simple and competitive prices.”

Javier Lipúzcoa

Head of Digital Banking at BBVA in Italy.

The first 100% digital bank with all the guarantees

BBVA has become the leading and innovative financial institution in the market using biometric solutions.

Veridas plays a fundamental role within BBVA’s value proposition and has contributed greatly to the bank’s achievement of leadership in the digital world.

With more than 55 use cases in 9 different countries, the BBVA group and its 81.7 million customers enjoy:

- Better user experience: in addition to the convenience of being able to carry out the procedures they need with their smartphone, wherever and whenever they want, users see the time required to carry out these operations reduced; avoiding waiting and queues at branches or offices.

- Increased security and fraud prevention: Veridas digital onboarding verifies the identity of the bank’s customers, providing confidence on both sides of the screen.

- Increased performance: The bank is able to offer more services online while maintaining maximum security, helping the business grow.

- International expansion: Veridas digital onboarding enables BBVA Italia to attract new customers anywhere and with any device. In addition, the BBVA group has already deployed 55 different use cases in 9 geographies.

The firm commitment to innovation and technology has led BBVA to be recognized for the fifth consecutive year as a leader in digital experience in Europe.

“Our value proposition aims to combine the product offering and solidity of a traditional bank with the customer experience of a digital player. We want to bring the best of both worlds to Italy: a universal digital bank.”

Onur Genç

Chief Executive Officer of BBVA

More than 720.000 new customers on board!

BBVA has already acquired more than 720.000 new customers through its ownly channel, the digital one, and thanks to our digital onboarding solution. These numbers have been a great success that have surpassed the banks’ initial objective set on October 2021.

BBVA Italy’s app is among the 3 top valued apps in Italy. The customer registration process has been a key element in the bank’s success, providing a safe and seamless user experience to its users.

![[DEMO GRATUITA]: Descubre cómo funciona nuestra tecnología en vivo](https://no-cache.hubspot.com/cta/default/19918211/d1b3c85c-877e-4b7b-934f-d69dd38dab05.png)

![[FREE DEMO]: Find out how our technology works live](https://no-cache.hubspot.com/cta/default/19918211/9d2f027d-2e80-4f2b-8103-8f570f0ddc7c.png)