Laboral Kutxa chooses Veridas and its digital onboarding to make it possible to open bank accounts 100% remotely and securely.

The solution allows the financial institution to meet its goal of improving their users’ experience by expanding its range of digital services, while maintaining the trust and security essential for both.

The challenge: Improve the user experience while maintaining trust and security.

As users, and thanks to technological and connectivity advances, we are increasingly looking to carry out procedures remotely, reducing those that require our physical presence.

An option that, until a few years ago, was unthinkable in the banking sector, where it was essential to go to a branch to carry out almost any type of operation.

In response to this new user need, Laboral Kutxa needed to find a solution that would allow them to capture new customers digitally, improving the user experience while maintaining trust and security.

In Spain, the Executive Service for Prevention and Money Laundering (SEPBLAC) requires the remote verification process to be carried out with a video-identification service. Veridas has a solution certified and accredited by Dekra to meet SEPBLAC requirements.

The solution: Veridas' digital onboarding solution

Veridas’ onboarding solution allows verifying a person’s real identity in less than a minute, with maximum security and the best user experience, while complying with all current regulations.

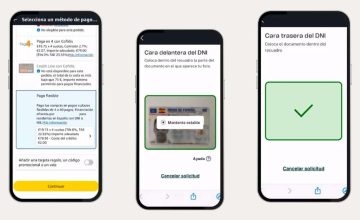

Through this solution, Laboral Kutxa offers its customers to open an account remotely, in 1 minute and with only 3 simple steps:

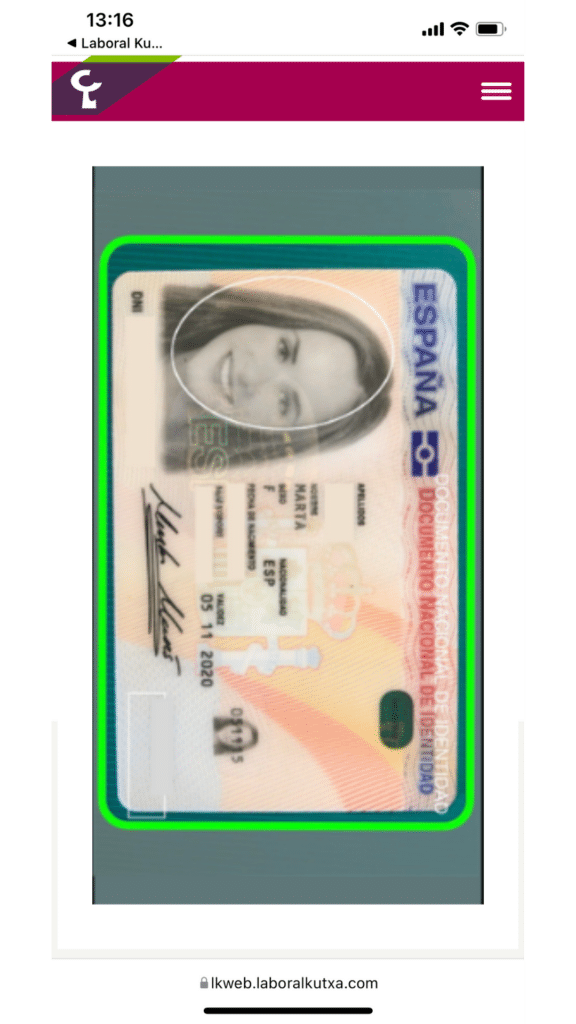

- Scanning the identity document. The customer must scan both sides of their ID document. Our document verification technology, capable of analyzing the security measures of more than 400 documents worldwide, will determine whether it is a valid or fraudulent document.

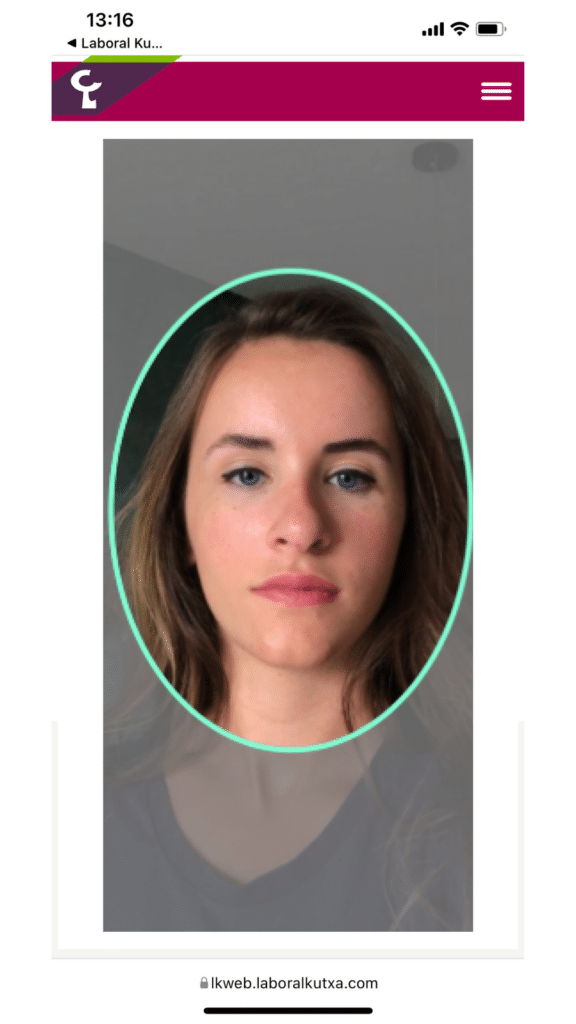

- Selfie. To corroborate the identity of the person, the user must take a selfie. Our face biometrics engine compares the photo on the ID document with the selfie taken during the process and determines if it is the same person.

- Video. To comply with the regulations of the Executive Service of the Commission for the Prevention of Money Laundering (SEPBLAC), the user must record a video of just a few seconds where he/she shows again his/her document and indicates his/her name and surname.

The result: a close and digital relationship with the customer

Thanks to Veridas’ digital onboarding, Laboral Kutxa has managed to:

- Reach more customers in a fast, accessible and secure way.

- Improve user experience. Customers can now open an account digitally, in 1 minute and with maximum security, from anywhere, without having to go to a branch.

- Competitive advantage over competitors. Not many banks today are prepared to offer this level of digital and remote service.

- Support sustainability: the digitization of procedures reduces travel.

Shall we turn your story into success?

Fill in this form and get in touch with one of our experts.