Home / Success Story

In a market growing at over 11% CAGR, any friction in the onboarding process results in immediate transaction loss and a decline in marketplace partner trust.

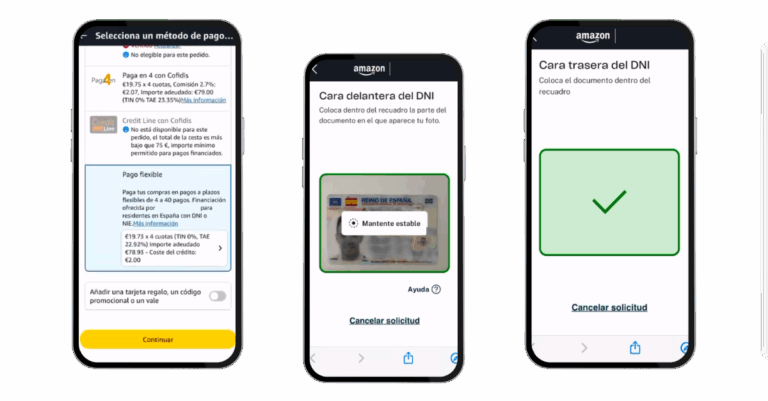

To solve this, the platform utilizes a sophisticated, tiered verification strategy tailored to the transaction risk:

This hybrid approach ensures the process remains fast, secure, and fully digital, providing the “impeccable traceability” required by the CCD2 without slowing down the customer journey.

/With the enforcement of the EU Consumer Credit Directive 2 (CCD2), the primary objective was to ensure that all credit origination processes are based on verified identity and impeccable traceability. The platform needed to demonstrate to auditors that its process was ethical, legal, and transparent.

/The platform required a solution capable of fast scalability to match its rapid international expansion and seasonal peaks. The goal was to build a system that could grow effortlessly across borders, such as the +740% growth in Germany, without the need for linear increases in manual operational costs.

/By leveraging Veridas’ IDV platform, this Credit Financing Company has moved beyond traditional “proxies” for identity like passwords or tokens that can be stolen, to establish absolute certainty in real time.

/The system ensures the presence of the real identity (the person) while simultaneously verifying the reliability of the device and the channel being used. By addressing the digital reality that true trustworthiness now depends on this “triad” of person, device, and session assurance, the company effectively stops sophisticated fraud, such as deepfakes and injection attacks, before they can compromise the system.

/This holistic approach not only eliminates human error and bias but also provides an intuitive digital service that keeps customers satisfied and the process fully auditable.

To deliver this vision, the Credit Financing Company implemented the Veridas Identity Verification Platform, a comprehensive, end-to-end solution where every component, from document OCR to biometric matching, is developed entirely by Veridas.

This total technology ownership allows the company to turn threats into opportunities by providing complete coverage against deepfakes and injection attacks while outpacing new threats through an adaptable, innovative roadmap. The proprietary engine ensures users verify on the first try across any channel, from mobile apps to social media browsers, creating a seamless, seconds-long experience that drives growth through trust.

By utilizing this 100% in-house stack, the company achieves:

Simplify entry, save time, and manage your stadium parking more efficiently.

Enter the parking area in under 1 second with facial recognition technology.

Simplify the ticket purchase process and enable attendees to enjoy a hands-free experience throughout their stadium stay.

Elevate your parking security for peace of mind.

Protect your Stadium with our end-to-end identity verification platform, featuring biometric and document verification, trusted data sources, and fraud detection.

Verify your attendees’ identity remotely in less than 1 minute.

Simplify the ticket purchase process and enable attendees to enjoy a hands-free experience throughout their stadium stay.

Enhance the security of the purchase process, eliminating the possibility of fraud, resale, and unauthorized access.